If you’re moving commercial samples into Northern Ireland (NI) you may be able to claim relief from Customs Duty.

What is a ‘commercial sample’?

A ‘commercial sample’ is defined as an item that can only be used in the UK as a demonstration sample of goods in soliciting orders for the types of goods they represent from potential customers of that product.

How to prepare commercial samples

For a product to qualify as a commercial sample, it needs to be altered in a way that makes it unsuitable for resale. There are different methods, such as damaging the item or labelling items with permanent marker. These and other methods are listed in the ‘How to prepare your goods to be used as commercial samples’ section on GOV.UK.

For example:

- For clothes, a cut or a tear made in the outer part of the garment and not on the seams or at the bottom – this should be visible when the clothes are worn

- For garments, the words ‘sample, not for resale’ printed in indelible ink would also qualify as a suitable alteration

How to claim duty relief for samples in TSS declarations

Before moving the samples, please be aware that:

- Samples of low value still require a commercial invoice

- The commercial invoice must reflect an accurate value of the samples

- You should check if your goods are controlled goods and if you will need licenses and/or certificates

Visit Guidance on controlled goods and the online tariff tool on NICTA for further information.

If the samples are staying in NI (or in the UK) only

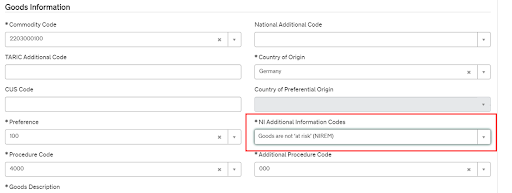

If you are authorised under the UK Internal Market Scheme, you can declare your samples ‘not at risk’ by selecting ‘Goods are not ‘at risk’ (NIREM)’ in the NI Additional Information Codes field. The field is located under the Goods Information section in Supplementary Declarations or Full Frontier Declarations.

You could use Additional Procedure Code (APC) ‘C30’ to claim duty relief if:

- Your samples are moved to Ireland or the EU

- The samples are remaining in NI but you do not hold UKIMS authorisation (if the commodity code has a positive duty amount)

- You are unable to declare your samples ‘not at risk’

- The goods commodity code is ‘not at risk’ due to applicable duties

Please note this APC does not provide relief from Excise Duty. You should follow the full guidance on GOV.UK.