Information correct as of September 2023

Claim reimbursement for customs duty paid on ‘at risk’ goods moved into Northern Ireland, if you can show they were sold or used outside of the EU.

As a result of the Windsor Framework, the Government launched the Duty Reimbursement Scheme on 30 June 2023. Traders can now reclaim EU customs duty paid on goods that moved into Northern Ireland and which did not subsequently move into the EU. Further information is available on GOV.UK.

The scheme enables the repayment of any such duties where the necessary evidence is provided and is backdated to provide reimbursement for relevant duties for goods moved from 1 January 2021.

Duties can be repaid where traders are able to provide evidence that goods were sold or used in Northern Ireland, moved elsewhere within the United Kingdom, or exported outside of the UK or EU.

Frequently asked questions

The DRS allows traders to reclaim EU duties paid on goods that have moved into Northern Ireland (NI) and been declared ‘at risk’, providing traders can supply evidence to show the goods did not enter the EU.

Your TSS declaration contains information that is required for the claim, such as:

- The movement reference number (MRN)

- Your GB or XI EORI number

- The amount of import duty that was paid to HMRC

This information is available on a completed Supplementary Declaration or a Full Frontier Declaration.

The TSS Contact Centre can support you to obtain this information. The contact number is 0800 060 8888. If you are not registered with the TSS, please visit our Registering Your Business page.

You can export a copy of your declaration from TSS. This is required as evidence for your claim. You can do this by following the instructions in section 8.3 [Produce a Report of Declarations with Duty Paid] of the How to use the TSS Portal guide on NICTA.

Yes there is a report available in TSS for all declarations by line items with duty paid within a calendar month.

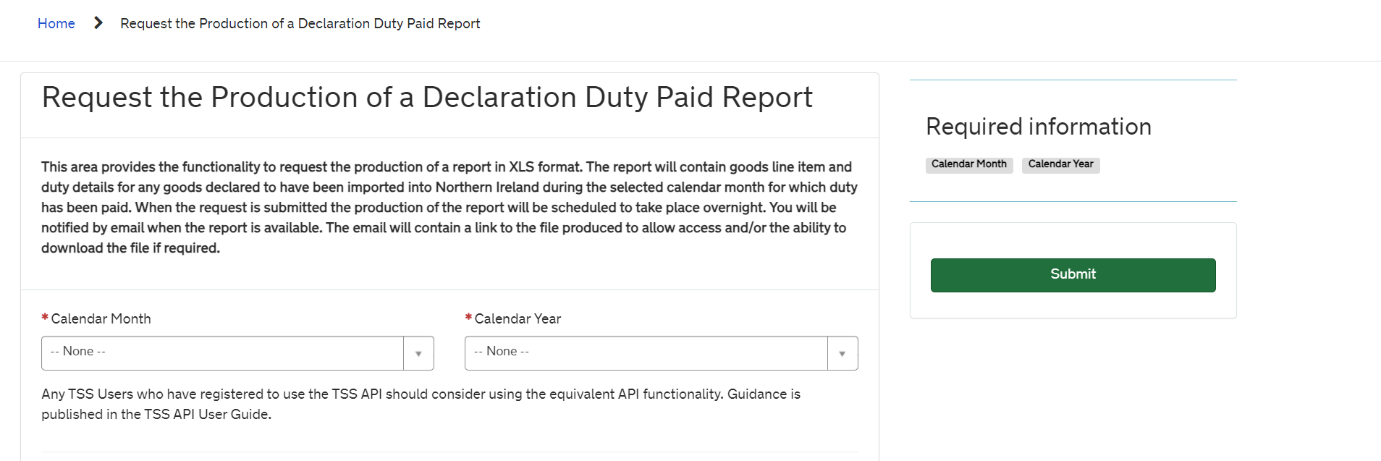

Traders should navigate to Start a declaration from the TSS Portal home page and select the option to Request the Production of a Declaration Duty Paid Report. This appears between the existing Export a Declaration and Inventory Linking options.

The report will contain details of all Supplementary Declarations within the specified calendar month, in which goods line items contain paid duty. The report shall be created as an Excel spreadsheet.

When a request for a ‘Declaration Duty Paid Report’ is completed successfully within the TSS platform, an email will be sent to the trader to advise them that the report is now available and can be accessed from the hyperlink provided in the email.

There are scenarios where a trader may claim a reimbursement for goods brought into NI, where the goods are:

- Onward movement from NI to GB

- Exported to Rest of World (a location outside of the UK or the EU)

- Final consumption in NI

- Permanent installation in NI

- Destruction in NI

- Physical retail sale or goods intended to be by physical retail sale in Northern Ireland

‘At risk’ refers to a situation where the goods that you move into NI are ‘at risk’ of moving into Ireland or another EU country, and are therefore subject to EU tariffs.

You can submit claims for goods movements dating back to 1 January 2021.

Yes, for goods brought into NI from 1 January 2021 to 30 June 2023 you need to claim before 30 June 2026 (within 3 years of the DRS scheme launch date).

For goods brought into NI after 30 June 2023, you can claim within 3 years of being notified of the duty owed.

You can make a claim on GOV.UK by signing in with your Government Gateway ID and Password and completing the digital form. (If you do not have a user ID, you can create one when you first try to sign in.)

You can claim reimbursement for EU customs duty paid on ‘at risk’ goods brought into NI where you have sufficient evidence to show the goods did not enter the EU.

- For movements of goods from GB to NI you can claim for the full amount of EU customs duty paid

- For imports to NI from a country outside of the UK or EU, if the EU duty was greater than the UK duty at the time of import, you can claim for the difference between the two rates

You can use the DRS:

- For EU duty paid on ‘at risk’ goods moved into NI since January 2021 that meet the reimbursement criteria

- Where you may not be eligible for other schemes such as UKIMS and you have evidence that goods you moved into NI were not ultimately sold into or used in the EU

- Where you cannot be certain of the end destination of your goods when you move them into NI, but can later show the goods were sold or used outside of the EU

- For ‘at risk’ goods moved

You must be the importer of record for the original ‘at risk’ movement into NI, or an agent acting on behalf of the importer of record.

Yes, you can submit a claim for a portion of the import duty paid on a consignment of ‘at risk’ goods.

For example, if you move a consignment of 100 ‘at risk’ goods into NI and 50 of those goods subsequently meet the reimbursement conditions, you can claim for the duty charged on those 50 goods.

This is dependent on the scenario under which the reimbursement claim is being made. All claims will be assessed on a case-by-case basis. A non-exhaustive list of evidence types is available on GOV.UK. Some examples include:

- Export declaration

- Sales invoice

- Commercial evidence, such as a VAT invoice

- Evidence of customer orders

- Packing list

- Transport documents

- Manifest data

- Bill of lading

- Inventory records

- Contracts for sale

If the goods you moved into NI have been processed you will need to provide additional evidence with your reimbursement claim. This may include evidence of the inputs, processing, and outputs to demonstrate that the goods you moved into NI later met one of the criteria set out above.

Additional evidence may be required if your goods are subject to EU trade defence measures, and further information is available on GOV.UK.

For example you could submit a sales invoice or receipt showing sale of the goods to a consumer located in NI or a contract for the sale.

Note: Where goods are sold onto another business or retailer in NI, commercial records will be required, including any assurance from the business that they intend to sell the goods to a consumer in NI, such as written agreements.

Further information is available on GOV.UK.

For example you could submit commercial documents and records showing evidence of actual consumption, such as inventory records showing that fuel has been used. Alternatively you could provide internal records showing that a substance has been entirely consumed.

Further information is available on GOV.UK.

For example, you could submit commercial documents and records showing goods have been permanently installed in NI, such as a certification of the installation of goods provided by building inspectors or other appropriate authorities.

Further information is available on GOV.UK.

For example, you could submit a commercial invoice for imported goods, inventory records and destruction certificates, such as a DVLA certificate of destruction in the case where a vehicle has been scrapped.

Further information is available on GOV.UK.

For example, you could submit a sales invoice or a contract for sale of the goods to a business or consumer located in GB, along with transport documents to show that the goods have been transported from Northern Ireland to Great Britain.

Further information is available on GOV.UK.

For example, you need to submit an export declaration and the Movement Reference Number (MRN) showing goods have been removed from NI to a location outside the EU and a sales invoice showing the final billing destination of the purchaser and shipping address for the goods as outside the EU.

Further information is available on GOV.UK.

There is no limit to the number of claims you can make.

Yes, you can submit a bulk claim to cover multiple movements of goods. You can do this as long as the claims are all based on the same reimbursement scenario, for example ‘retail sale in NI or destruction of goods in NI’. Bulk claims containing more than one scenario will be rejected. The bulk claim must also be for the same importer.

There is a limit of 250 individual consignments or Movement Reference Numbers (MRNs) per bulk claim.

For example, you may wish to make a bulk claim in the following scenario:

- You made multiple movements of ‘at risk’ goods into NI

- The goods were all destroyed in NI

Goods subject to an EU trade defence measure cannot be included in a bulk claim.

You do not need to supply evidence for all goods movements with your claim, instead you will need to hold the relevant evidence that relates to each individual movement of goods covered in a bulk claim and be able to provide this upon request from HMRC.

No, you must be the importer of record for the original ‘at risk’ movement into NI, or an agent acting on behalf of the importer of record.

You will get an email to confirm that HMRC has received the form. This email will contain a unique reference number.

You do not need to do anything further until HMRC write to you regarding your claim. HMRC will confirm if your claim is approved, and if so they will send you a letter to let you know and will reimburse the duty either by bank transfer or current month amendment (CMA). Alternatively they may ask you to provide additional evidence.

Ready to apply?

Apply to claim now on GOV.UK.

Still have questions?

If you need more information please contact the TSS Contact Centre.

The Trader Support Service will also guide you through any changes due to the implementation of the Windsor Framework.